Every year, I topup to CPF Special Account/Retirement account to enjoy tax relief and the high interest rate from CPF.

For maximum tax relief, I will transfer $7,000 to my dad’s retirement account (RA) and $7,000 to my own special account (SA).

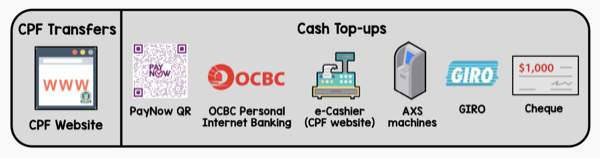

But CPF support for sending cash to them is very poor. Only 1 bank – OCBC – is supported. How could Singapore’s flagship DBS not supported!? Luckily for me I have a dormant OCBC account.

Many people would have missed out this CPF hack benefit because of the limited channels to send cash.

At last, now all banks can transfer cash to CPF

CPF now adopts PayNow, which all banks support.

The steps:

-

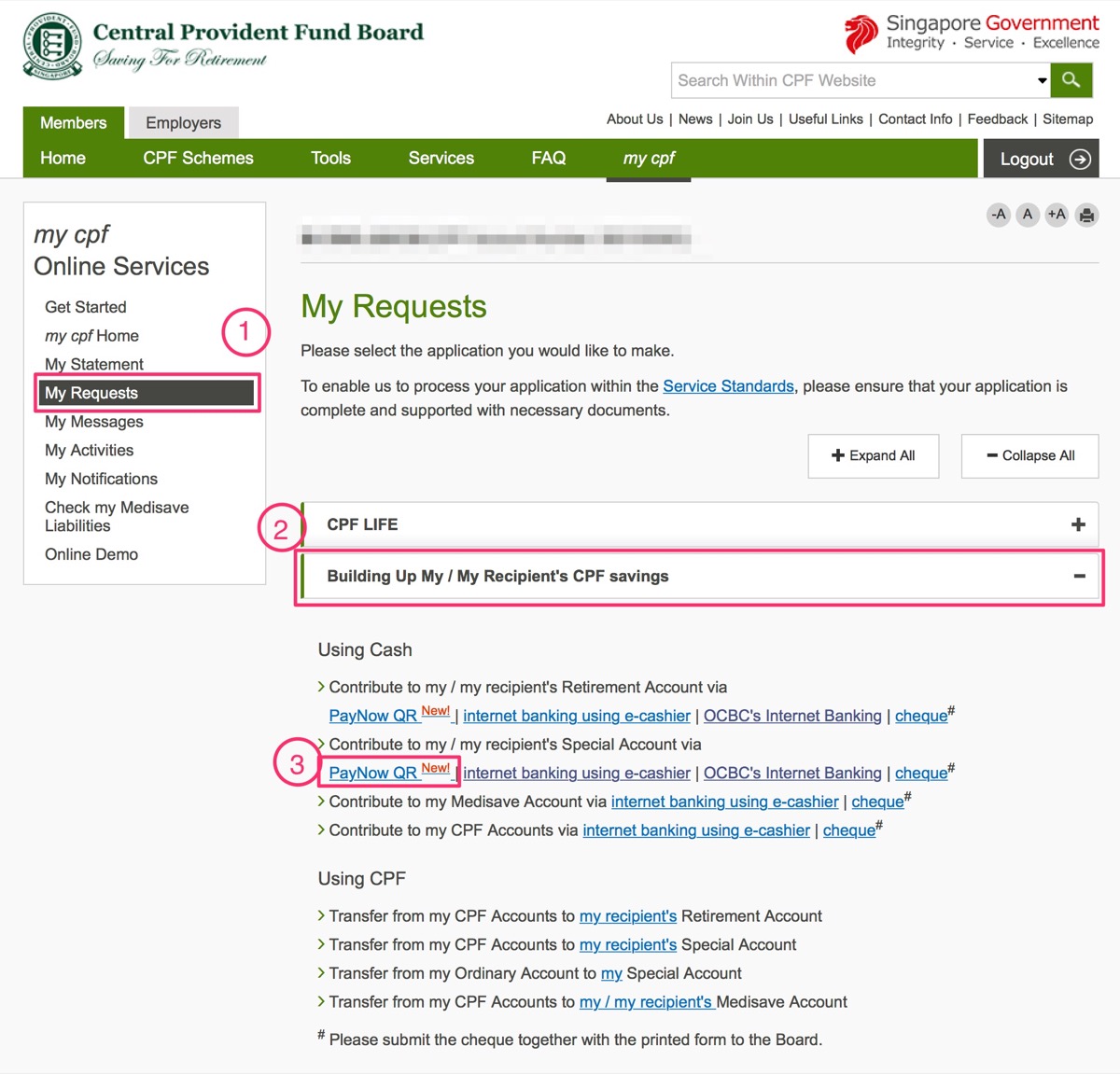

Login with your SingPass.

-

Submit an online application via My Requests > Building Up My / My Recipient’s CPF Savings.

There are a couple of extra intermediary confirmation steps.. Make sure you select Paying as a member, Payment for Top up my SA …, and enter your own NRIC number in the Recipient’s CPF Account Number.

-

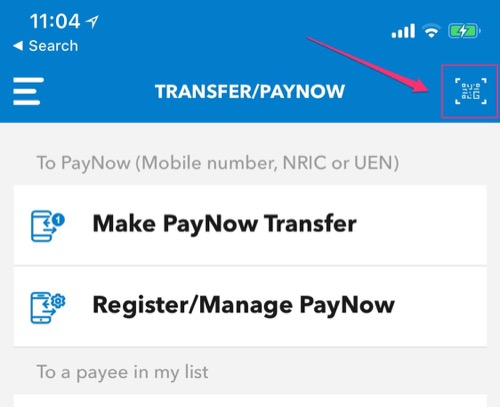

Login to your bank’s mobile app

-

Scan the QR code generated with your bank’s mobile app to make payment.

In DBS app, you need to tap on the top right QR icon.

This is pretty bad UX because tapping on “Make PayNow Transfer” will not give you the QR option, while that obscure small icon is easily missed.

Similarly, top up for parent’s RA

The maximum relief is $14,000 = 2 x $7,000. So I top up $7,000 for my own SA, and another $7,000 to my dad’s RA.

The steps are similar for topping up for my dad’s RA.

In the request, select Contribute to my / my recipient’s Retirement Account via, and finally your parent’s NRIC number.