UOB One Account increased interest rate, increased balance cap, and still give me a free Famous Amos cookie!

So nice of them! Right?

Nope, there is always a catch

You have to read the details on the change.

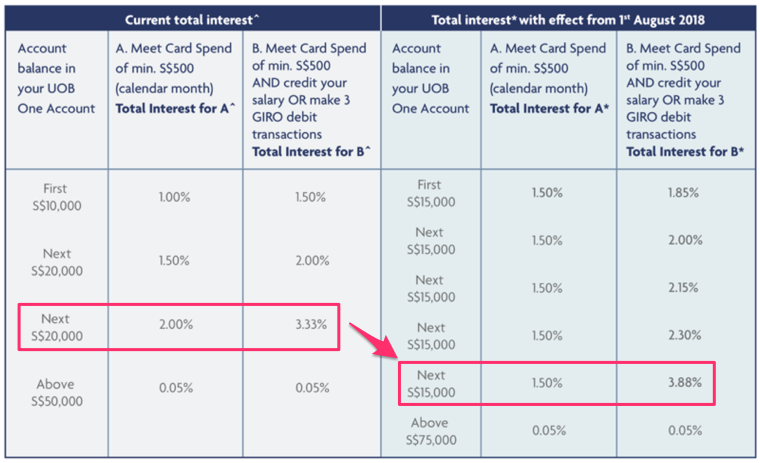

They claim to have increased interest rate from 3.33% to 3.88%.

That is only true for the last tier amount of $15,000. It is stupid and pointless to look at the interest rate for 1 tier. That’s a marketing gimmick.

Instead, the effective interest rate (EIR) is what truly matters.

The real “increase” is from 2.43% to 2.44%. That is a 0.01% increase..

Beware, if you have only $50,000

If you are like me, who keep an optimum amount of cash balance to earn the optimum interest, then you are in trouble.

With the new change in effect, applying the new tier of interests, your $50,000 will earn $1,015 instead of $1,216 (before change). That is $201 lesser!

The new optimum is $75,000

Hence, you should increase your balance in order to enjoy the EIR of 2.44%.

If you are okay to put in $75,000 cash, then there is a good news.

You will earn $1,827 interest every year, that is $611 more!

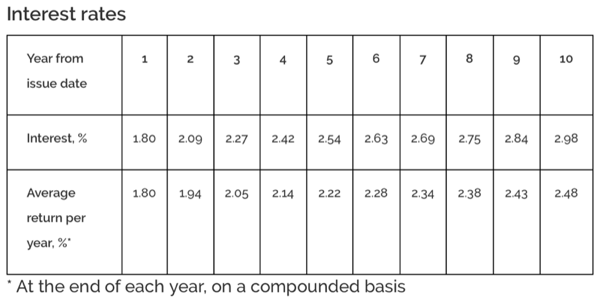

If you have beyond this optimum amount, you should invest in Singapore Savings Bond which effectively give you 2.48% in 10 years (for November 2018, and expected to go up), with no other tedious conditions.

One final lesson.

There is always a reason when someone gives you a free cookie.