Singapore Savings Bond (SSB) is a bond issued by the Singapore Government.

It is a voluntary way for individuals to lend money to the government, with 2-3% interest (as of Feb 2018).

Singapore Government is borrowing not because it is poor. She is “borrowing” because many individuals save too much cash in the bank, which doesn’t grow, so the government wants to help by making better investment for them.

In return, Singapore Government gives a interest of 2-3%, but at near zero risk.

Personally, I make my first SSB investment in the Feb 2018 bond issue, which coincidentally is the first time in history that the bond is oversubscribed!

As of March 2017, more than 40,000 individuals hold more than S$1.1 billion of SSB on aggregate. So on average, an individual invest $27,500 in SSB. Should you do the same?

Why should you put your money in SSB?

- Because the interest is better than fixed deposit or bank’s interest.

- Because you can withdraw whenever you want.

- When you withdraw, you take the principal sum back in full.

- And it is very very low risk.

As mentioned in Ray Dalio’s All Weather Portfolio, he allocates 40% of his money in long term government bond.

SSB is a long term government bond (up to 10 years), and you should use it to form the foundation of your investments.

Check out this month’s bond.

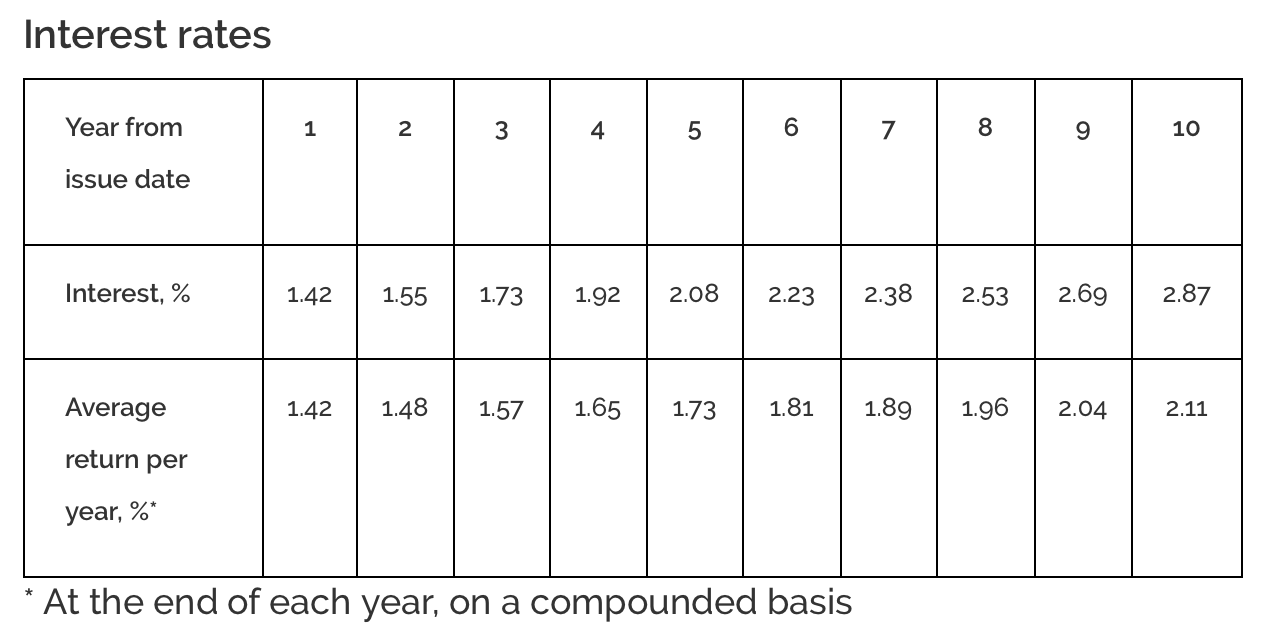

I took the following screenshot of the interest rate over 10 years, for the Mar 2018 issue:

The interest rate is tiered, with coupon payments increasing every year. If you hold to maturity (10 years), then the effective interest rate is 2.11%.

More SSB FAQs.

Guide to Buying

You need these to get started:

- CDP Account

- DBS/POSB, OCBC or UOB bank account

- $500-$50,000 cash to buy :)

Apply through your bank’s internet banking. I applied via my DBS.

A $2 transaction fee is charged by the bank.

To redeem your bond early, you have to submit your request via your bank’s internet banking. You will receive the full principal sum by the following month 2nd business day, with pro-rated interest.

Other Notes:

- You may buy a maximum of $50,000 in each bond issue

- You may hold a maximum of $100,000 in total

- Therefore, you can buy 2 x $50,000

- A new bond will be issued every month (at least up to year 2020)

- Handy Calendar & Calculator

SGS vs SSB

Singapore Government Securities (SGS), is another government bond that we could invest in.

Singapore Government and MAS introduced SGS way back in 1998.

SSB is another effort, introduced in 2015, with the following unique features:

SSB bond price is fixed, never traded in open market (unlike SGS), and investors may redeem anytime.

These SSB features is to appeal to individuals with low risk appetite yet favoring liquidability.

SGS and SSB interest rate is similar. The difference is that for SGS, when you redeem the bond early, you run the risk that the bond price is lower, therefore you might sell your bond at lower than your full principal sum.