I advise my parents to select the Escalating Plan.

Some people overthink with Internal Rate of Return, and choose a plan based on how long you can live. I don’t even think the way they calculate is fair.

The monthly payout is for living expenses, not to use for any investment.

As I have been telling my mum, how long we can live is unexpected, so she should use all of the payout to buy what she wants. Use it to enjoy!

Payout is like Dividend

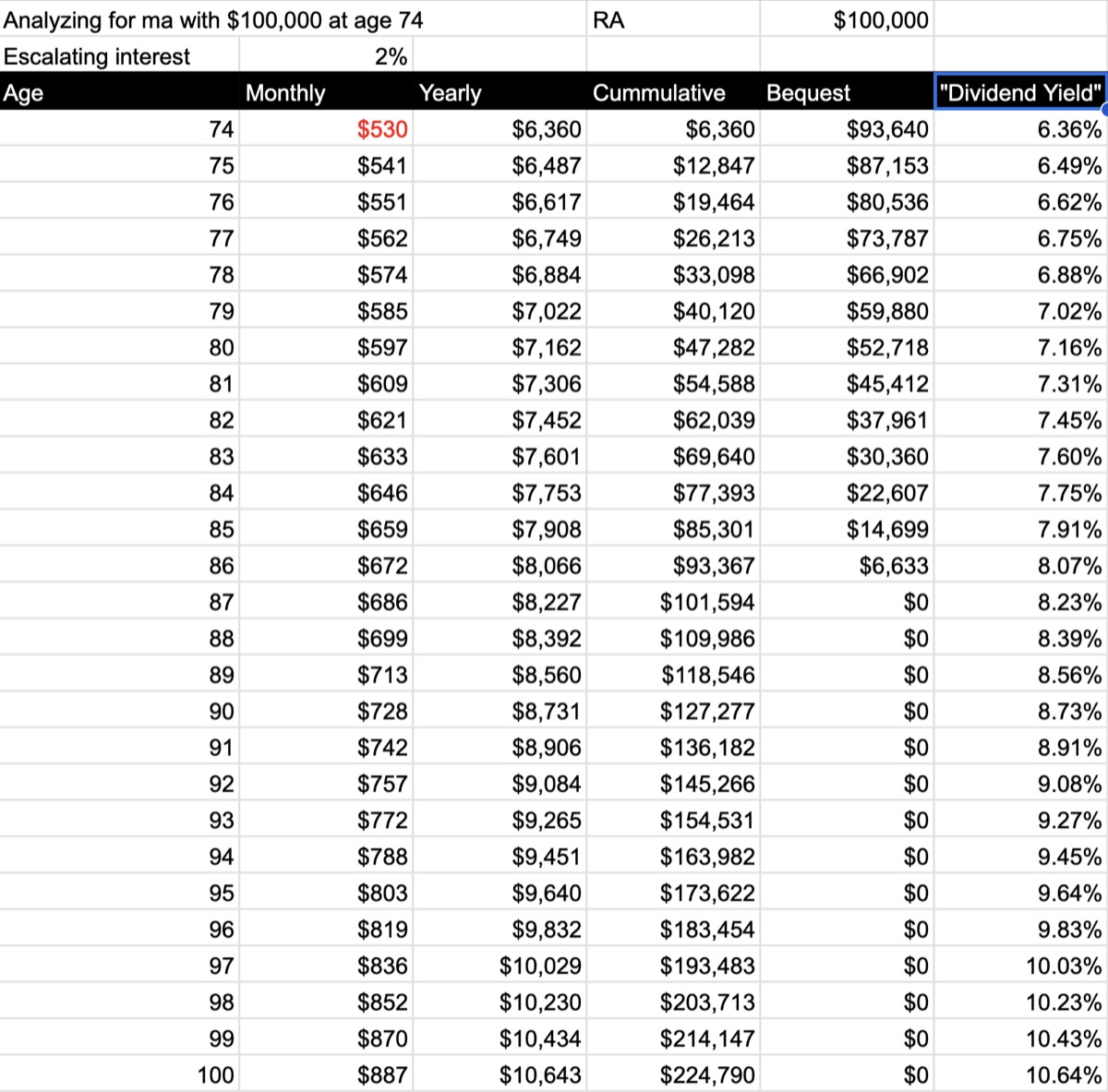

Say you have $100,000 in your Retirement Account and you started to receive payout. In essence you’re receiving lifetime dividends. As such, you can look at the “dividend yield” for each plan.

Here’s the yield for Escalating Plan for my mum:

The yield for Standard Plan is a fixed 7.8% (as the payout is fixed to $7,800 a year).

So Escalating Plan started out at “lower yield”, then exceed Standard Plan at age 85 for my mum (11 years later).

I even did a comparison of the yield based on the starting amount.

Hedge against inflation

The Escalating Plan is also a hedge against inflation, which averages 2%. So logically, the payout should increase every year so that your spending can keep up with inflation.

In case you didn’t know, the 2% increment from CPF is compounding.

What about bequest?

If you pass away, there might be leftovers for your beneficiaries. This leftover amount is simple.

If you join CPF Life with $100,000 and has drawn $20,000 in total payout, then the remaining bequest is $80,000.

There is NO interest on the CPF premium.