My dad is 68 and he was asking me about CPF withdrawal.

My first reaction is to ask him to delay till 70 year old, because the interest rate is 6%. I was wrong about the interest rate, because it is just around 4%.

CPF is a good system, but the concept and names they use is just too damn lousy and inconsistent.

CPF LIFE vs Retirement Sum Scheme

There are 2 different schemes, with the LIFE scheme introduced in 2009.

They are so inconsistent with names because “CPF LIFE”

- always prefix “CPF” (while the other scheme doesn’t)

- and LIFE is uppercased for no reason

If I was designing the product, I would name it “Life Scheme”.

Anyway, CPF LIFE is simply a newer and better scheme that pays till one die.

Retirement Sum Scheme (RSS) pays for a finite number of years. The problem comes when you live long enough, and you out-live that finite number of years. With better healthcare, we now live longer, and RSS can become problematic.

CPF LIFE is better, though it pay lesser. There is a social safety net because everyone put into a common pool that pay the retirees, for as long as everyone lives. If you live shorter, you kind of lose out. So the scheme encourages you to live longer 😃

CPF LIFE is providing an insurance against living a long life.

CPF LIFE is now the default, and everyone should just forget about RSS.

How CPF Life works

It works something like this:

- You decide when you want to start the pay out, between 65-70 year old.

- Once you decide to start payout, your retirement account will contribute to the pool that pays out monthly.

The complexity comes from the many nitty gritty details.

Retirement Sum

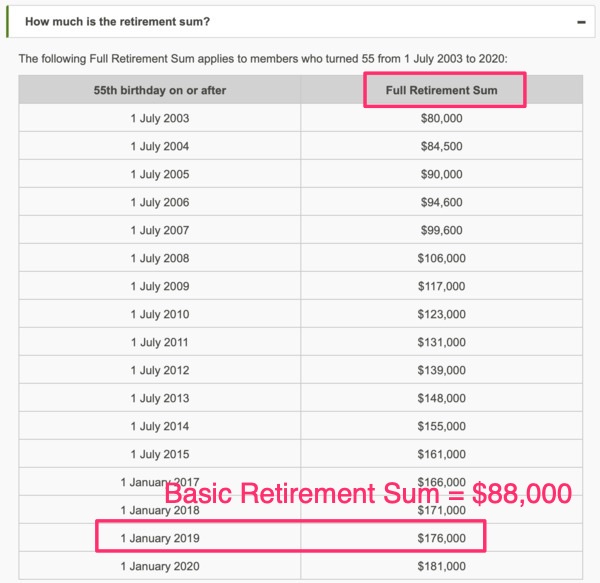

Retirement Sum is the amount that you set aside, and it will increase over the years. From CPF website:

In the above, “Full Retirement Sum” is $176,000 if you are 55 in 2019.

Hey, what exactly is the “Full” in “Full Retirement Sum”?

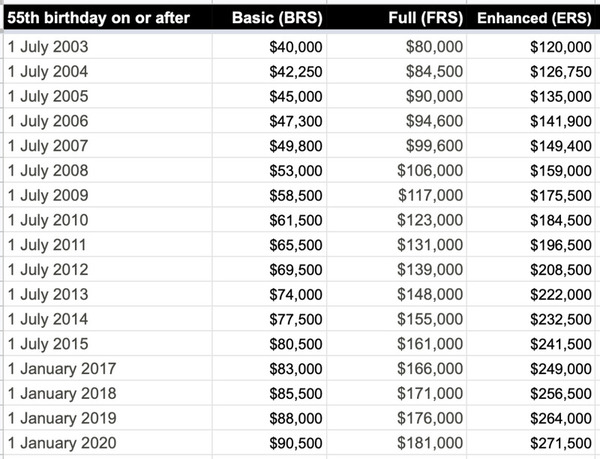

It turns out there are 3 Retirement Sums:

- Basic (BRS)

- Full (FRS)

- Enhanced (ERS)

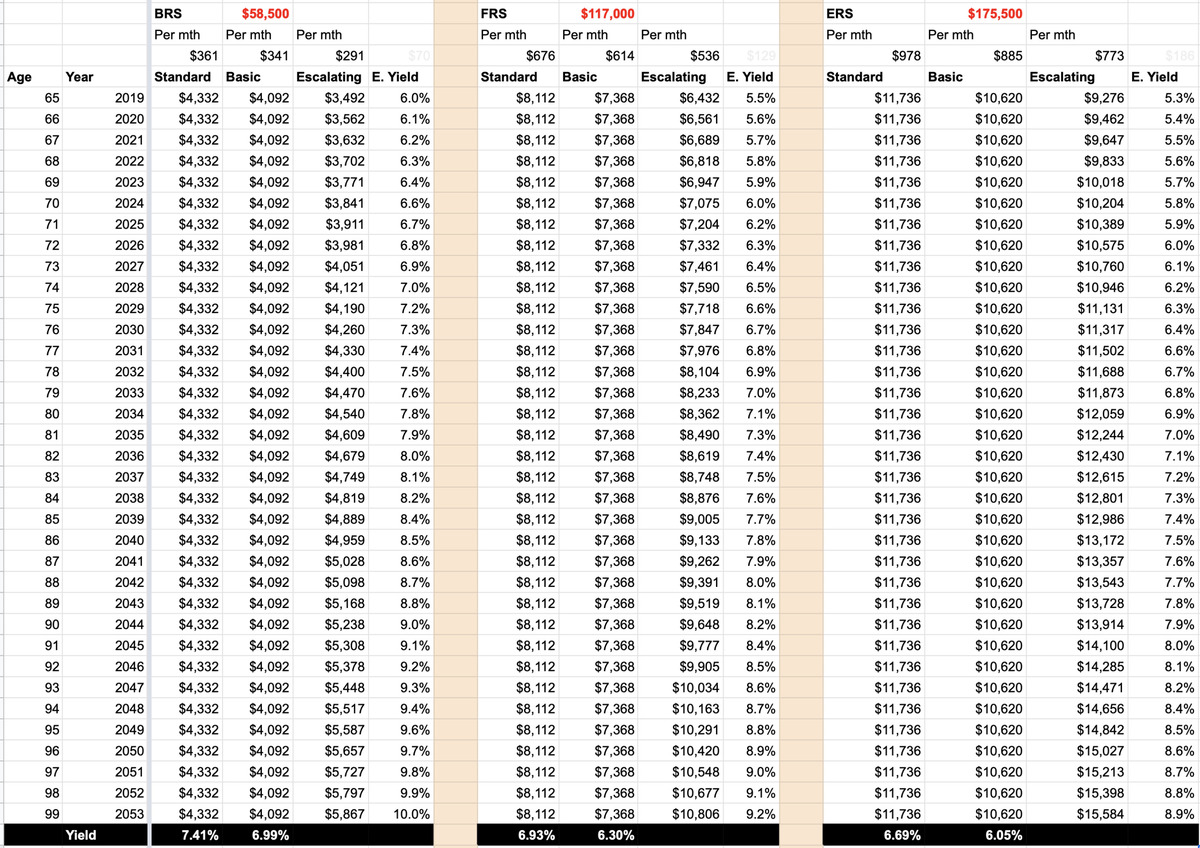

For some reason they don’t show the 3 sums in 1 table. I created in my spreadsheet.

The difference between the sums is that they are in multiples. FRS = 2 x BRS, ERS = 3 x BRS.

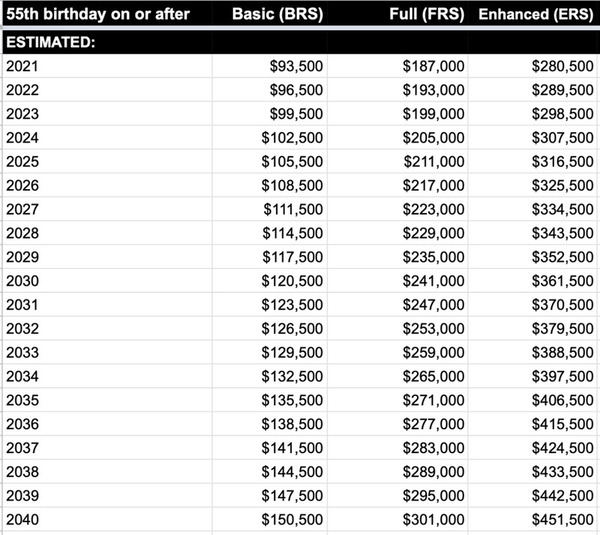

CPF will determine what is the BRS every year. It is not surprising that it increases. On average from 2003-2020, the BRS increased $3,156 every year. Rounding it to $3,000, this is an estimate till 2040.

Hmm.. I will be 55 in 2038, hence I estimate my BRS to be around $144,500 by then.

Of course, the larger your retirement sum, the more payout you will receive. I will not go into further details about withdrawing one-time lump sum, after setting aside for the retirement sum. I will also not go about how you can pledge your property if you have not enough for BRS. You can read more here.

The fact is, as long as you qualify for CPF LIFE, you will have payout.

Then comes the payout plan

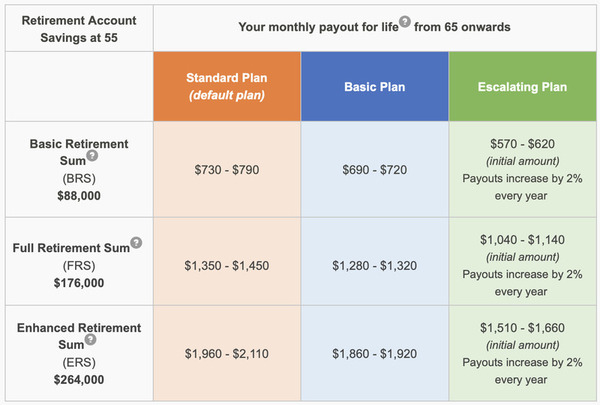

To complicate things, there are 3 plans with different payout amount and bequest.

- Standard

- Basic

- Escalating

Again, their choice of names is terrible.. Standard, Basic, Full, Enhanced, Escalating, Ordinary, Special..

You look up your Retirement Sum set aside, choose your Payout Plan, and that gives you your monthly payout.

NOTE: The table above is for someone who is 55 today, with that Retirement Sum set aside, and who will be getting payout 10 years later (at 65). In between that 10 years, the retirement account will be gaining compounded interest.

If you want to know what is the payout today, with your current retirement account, then you have to use their calculator.

BRS, FRS and ERS is like a guideline. The actual payout is determined by your retirement account balance when you request to start the payout.

The Payout Rate

CPF LIFE is like insurance annuity. How does it fare as an annuity giving out money every year? What would be the “yield” from an investment perspective?

I created a simple spreadsheet to find out.

The scenario: A 65 year old today, who wants to start CPF LIFE payout next month. His BRS is $58,500, FRS is $117,000 and ERS is $175,500. I use the calculator, and use the minimum of the estimated monthly payout to generate the payout table below.

From a simple yield perspective, BRS > FRS > ERS. That is understandable as the country should be taking more care of the poor.

BRS with Standard payout plan gives the highest yield at 7.41%!

This yield, or payout rate, is definitely very high, for now.

Basic Payout Plan is around 0.5% less than Standard. This should be called the B Plan (B for Bequest!). IMO, you should not consider on having a bigger bequest, because even if there is any bequest amount left to beneficiaries, it is without interest.

I would advise my dad to take Escalating or Standard Plan, and live long 😃

Escalating is interesting because it increases by 2% every year, to cover for inflation in the future. After 26 years of payout, Escalating would “break even” with Standard. Thereafter it continues to give more.

If mankind achieve immortality.. the Escalating Plan will not be sustainable 😆

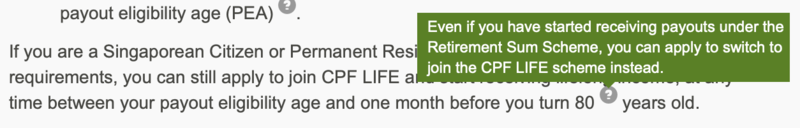

You can join CPF LIFE till 80

My mum is a housewife, and she does not have much CPF. Yet with that little CPF, she is drawing from the older Retirement Sum Scheme.

Then I found out it is still possible to switch to CPF LIFE as long as you have not reach 80.

Since it is possible to transfer to my CPF to my parent’s, or to top up their retirement account, I should take a good look on how to have my government pay my mum 😃

- How You Can Easily Earn $32 of Free Cryptocurrency From Coinbase →

- ← CPF Interest is up to 6%. That is Marketing Bullshit.