Singapore Budget 2018 announced that GST will be imposed on digital services from 2020.

The time has finally come.

I took a day to learn all about GST. This post is to share what I’ve learnt and how it affects me as a self-employed sole proprietor (yet also applicable to company/LLP).

Apple App Store

As an app developer, I received an email from Apple on how App Store will affect the change:

Due to tax regulation changes that go into effect on January 1, 2020 in Singapore, developers based in Singapore must provide their Singapore Goods and Services Tax (GST) registration status in App Store Connect by January 13, 2020.

If you provide your GST Registration Number, your proceeds will not be affected.

If you do not, you will be considered taxable per Singapore GST laws and regulations, therefore you will be charged 7% GST on WORLDWIDE commissions payable to Apple.

Please note that Apple does not administer GST on sales to customers in Singapore for developers based in Singapore. You are responsible for determining if GST applies to your sales and for remitting GST to the Inland Revenue Authority of Singapore (IRAS).

UPDATE on 16-Dec-2019: The email is utterly confusing, and it took me long to finally get this correct (I hope). The following is now corrected.

Apple gave Singapore developers 2 choices:

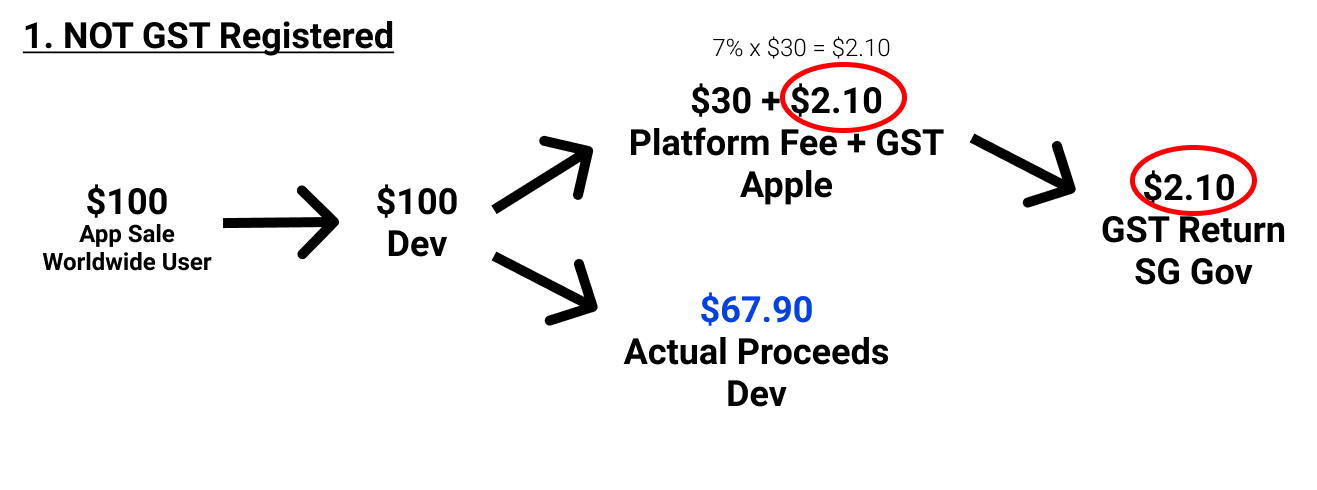

- Don’t register for GST -> Apple charge 7% on WORLDWIDE commissions payable to Apple

- Register for GST -> Proceeds unchanged (but you have to file GST return)

The first confusion is what exactly is charged in (1)?

Ans: It is 7% of the 30% commissions payable to Apple. That means another 2.1% to Apple.

Why is it chargeable WORLDWIDE when GST is only applicable to Singapore?

Ans: That’s because the GST is on providing the (worldwide) platform to a Singapore developer.

This diagram illustrates the flow of money, with Apple returning GST to Singapore Government, for the GST charged on the platform fee.

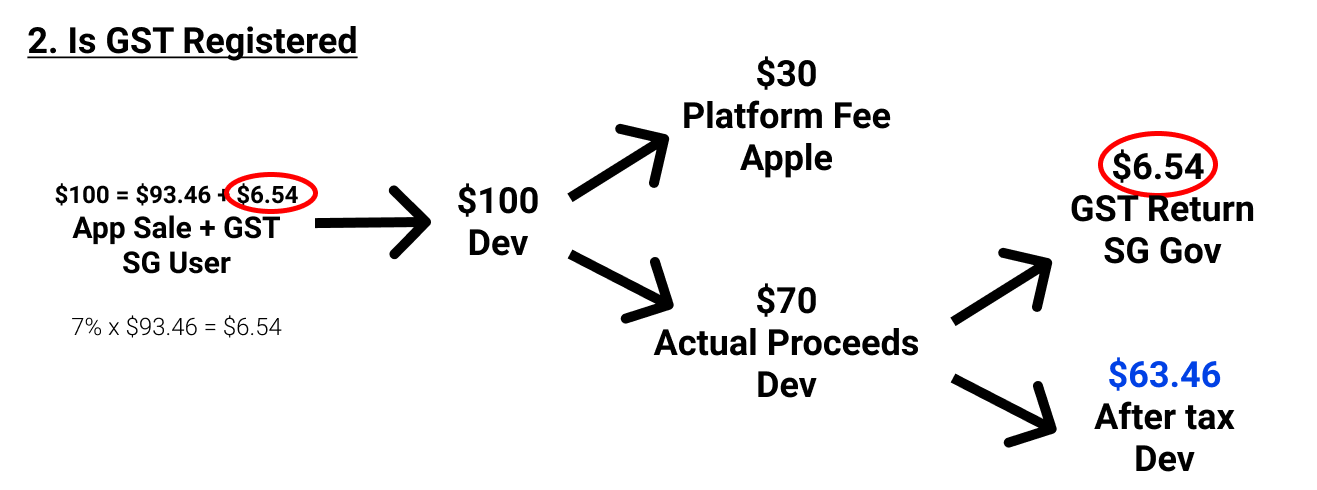

The next diagram is for (2), where the developer is registered for GST. What is different now is that the GST is charged on the Singapore user who paid for the app.

Further clarification:

- In the diagram, a developer collects the whole $100 as revenue, then pay Apple a 30% commission as a form of expense.

- But the reality is Apple deducts the commission first, then give the remaining to developer.

- GST is applicable to only goods & services consumed in Singapore

- In (1), the service is the platform

- In (2), the service is the app

- GST is incurred by the last person who is NOT GST registered

- In (1), it is the developer

- In (2), it is the app user

- GST collected is ultimately returned to the Singapore government

If you wonder how Google Play handle the GST, you can read about it in later section. In short, Google is much better than Apple.

To register or not?

In terms of final proceeds, this is what the 2 choices mean:

- NOT GST registered -> all proceeds drop to $67.90

- Is GST registered -> Singapore proceeds drop to $63.46 (non-Singapore proceeds remain $70)

The choice depends on the developer’s revenue.

I will register for GST because:

- My Singapore revenue is only ~2% of my total

- Therefore I want my non-Singapore proceeds to remain $70 (instead of $67.90 if I am not registered)

What is wrong with Apple?

Being GST registered means adding on an extra tax to the last consumer – the Singapore app user.

If I have absolute control over the app pricing, I would now charge $107 instead of $100. That is truly adding $7 as GST.

I would then give Apple $30, and I take $77.

After returning the $7 GST to government, I would end up with $70!

But here is the problem:

Apple platform does not allow adding of tax on top of the price tiers.

A $0.99 app will still be $0.99, though it now includes GST.

You only need to pay GST if earn > $1 million?

If you are thinking I earn more than $1 million, hence I am filing GST, it’s not. I wish though.

It is mandatory to register for GST if you earn more than $1 million in taxable turnover.

But you can register GST voluntarily too.

Any benefits to registering for GST?

A GST registered business may also claim for GST when the company pays for expenses (that has GST) in order to run the business.

In other words, I can actually get money from IRAS.

Let me use my business as an example. As an app developer, it is right for me to buy computers, so that I can produce software to sell.

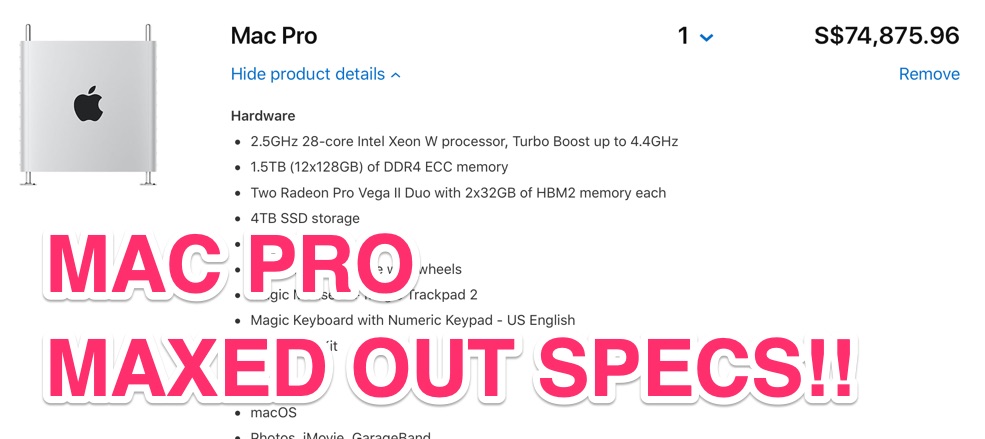

If I buy the Mac Pro..

If I buy the Mac Pro..

The latest Mac Pro with a max-ed out specs will cost a whopping $74,875, inclusive of GST of $4,898.

This $4,898 is aka input tax, is what I can claim back as cash from IRAS.

On the other hand, output tax is the GST that I have collected from my users (who purchase my apps), and I have to pay IRAS. I was merely collecting tax for IRAS.

Once again, if you see how the money flow down, GST is basically tax incurred by the last consumer who consumed the goods/services, and is not GST registered, and therefore doesn’t get any money back.

I can claim for entertainment too

The GST to claim is also allowable for entertainment (food, drinks), as long as it is for the purpose of the business. There is a guide on the general rules. For example, it is NOT ok to claim for every lunch, but OK to claim for a business meeting because it increases business efficiency.

These are generally OK:

- Team bonding activities

- Gifts for birthday, special occasions

If an item has partial private usage, it is possible to pro-rate it.

Though an important NOTE on gifts:

- With input tax, comes output tax

- If the value > $200, you need to account for it! Which means net-net you claim $0.

- So generally, don’t spend > $200 on a gift 😄

How would this affect my accounting?

As a sole proprietor, I only need to do accounting annually during personal income tax filing.

Now, I need to do it quarterly, as GST filing has to be done quarterly.

Net Tax Payable = Output Tax - Input Tax

On the balance sheet, Net Tax Payable will be under Current Liability. It is the amount that I will pay Iras (if negative, will be what Iras owes me)!

As a sole proprietor, I only need a simplified profit & loss (P&L). With GST, the P&L becomes:

Revenue - Expense - Net Tax Payable = Adjusted Profit

The actual income is now Income after tax.

It is also to be noted that reporting the GST return is a self-assessed exercise. I have to do the accounting myself, and has to be responsible in my book keeping, because I could be audited.

e-filing

During e-filing, there are couple of boxes to fill in the number$.

- Supplies - what you sell

- Box 1 standard-rated revenue, excluding GST

- Box 2 zero-rated revenues such as derived from overseas

- Box 3 exempted revenues such as residential properties, financial services/interests, crypto, precious metal. Exempted supplies are like zero-rated, except input tax incurred from exempted revenue is NOT claimable.

- Purchases - what you buy/import

- Box 5 total value, excluding GST

- These are purchases with GST, and to claim

- Including zero-rated too

- Box 5 total value, excluding GST

- Taxes

- Box 6 output tax to pay (Box 1 x 7%)

- Box 7 input tax to claim

- Revenue

- Box 13: Total revenue, kind of FYI for IRAS

Data from App Store Connect

We need to know the output tax from App Store sales.

Go to App Store Connect > Payments and Financial Reports > Create Reports > Select Singapore > for every month > download the CSV. The following are important:

- Partner Share is the commission given to developer per unit

- Customer Price is the unit price the consumer pay (GST inclusive)

- Quantity is the number of unit

Therefore,

- Revenue = Quantity * Customer Price

- Expense = Quantity * (Customer Price - Partner Share)

- Box 1 = Revenue / 1.07

- Box 6 = Box 1 * 0.07

As per diagram (2) where revenue is $100, Box 1 will be $93.46 and Box 6 will be $6.54.

The expense (commission to Apple) is not needed in IRAS e-filing, but needed in accounting for the business.

GST to increase to 9%

It is already known that GST will increase by 2% in 2021-2025

When that happens, app developers will simply earn lesser (after tax). Be it 7% or 9%, app developers have no say in the pricing, and simply absorb the tax. A $2.99 app will still be $2.99 – Apple dictates the price.

It will be different if Apple can apply the GST on top of the app price.

How is Google Play handling GST?

Google is better.

Google will send the applicable taxes for paid apps and in-app purchases made by customers in Singapore to the appropriate authority, so you won’t need to calculate and remit Goods and Services Tax for Singapore separately for these customers’ purchases. No other action is required on your part.

Google takes care of the tax for ALL developers – including the non-Singapore developers. This is so much more helpful as a marketplace provider.

Singapore Government will also love Google more since the tax collected with be accurate, and hence more 💰💰.

More Resources

I took a few hours to complete the 2 e-learning courses which are necessary for voluntary registration of GST. They are very place to start learning. And I passed the tests.

There is a e-Tax guide on how it affects the digital economy. Marketplace (such as App Store) and overseas suppliers (overseas developers) are also required to abide by the GST laws, under a simplified regime – Overseas Vendor Registration.

I suppose IRAS want overseas developers to declare the revenue derived from Singapore users, and pay for the GST accordingly. It is mandatory if the concerned revenue > $100k in a year. But this is not strongly enforced, yet, and I believe most overseas developer doesn’t know about Singapore this.