This is a follow up post to show how much I “earn” from selling my 6 years old BTO. It is merely for reference, to see how the monies played out.

It is not easy to calculate the “profit”, as I there are interests paid to HDB/Bank, which I didn’t track, and without properly considering inflation, depreciation of renovation, and risk-free interest over the years.

The key point I want to highlight is this: CPF accrued interest is very high.

Cashing in~

Cashing in~

Bought BTO for $340,000

In 2014, the house TOP-ed, and we moved in.

The purchase price is $340,000, excluding renovation, and a bit of stamp duties and legal fees.

Sold for $500,000

In 2020, we sold it for $500,000.

$500,000 - $340,000 = $160,000

The profit seems to be $160,000? Of course not!

1. Interests Paid

We paid interest to HDB & Bank for the loan (we switched from HDB to Bank midway). Estimated we paid $30,000 just for the interest over 6 years.

Then there’s CPF accrued interest of $32,000.

2. Inflation

Even kopi cost more now than 6 years ago.

Let’s assume an increase of 2% every year. In 6 years, the property should have increased by $40,000.

3. Renovation

Then there’s $50,000 paid for renovation and furnitures. While these are mostly sunken costs, except for the mattress we will take with us, we will consider the whole sum as the cost.

Actual Profit

If you considered all the above costs,

$160,000 - $30,000 - $32,000 - $40,000 - $50,000 = $8,000

Right, the actual profit would be just $8,000! Not really huat ah?!

Why sell?

I didn’t sell because I want to make a profit. To me, a property is a place of belonging, not an investment.

I sell the HDB so that I can upgrade to a bigger place, with 1 more room for my parents.

Breakdown of the monies

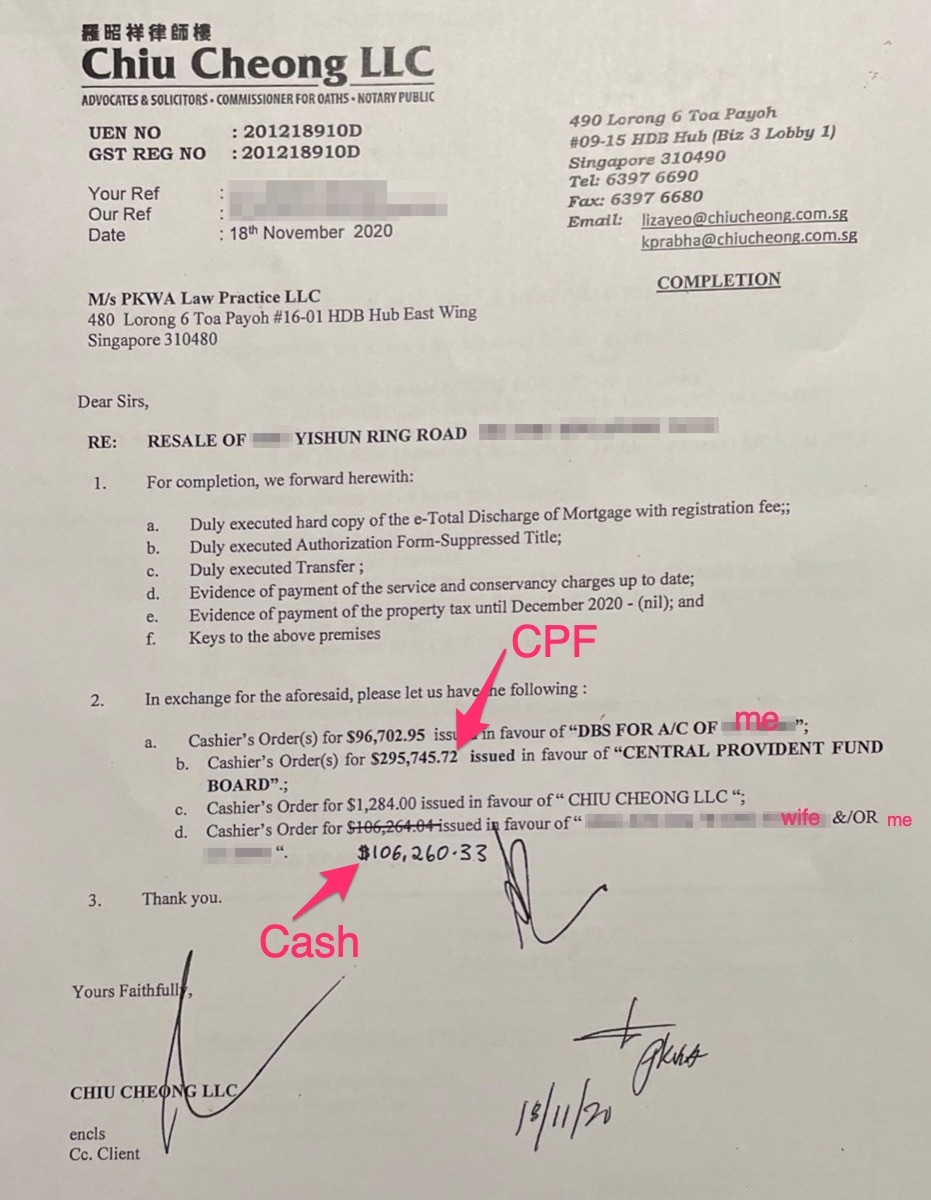

When the HDB is sold, there is a breakdown of how the $500,000 is distributed to each party. It’s quite interesting to finally see how the monies are given out. My conveyancing lawyer will manage the monies.

- Return my bank the remaining mortgage – $96,702.00

- Return CPF – $295,745.72

- Pay lawyer – $1,284

- Pay me the cash – $106,260.33

If you add up 1-4, it will be $499,993. That’s because $7 was already paid to me as option fee.

Return $296k to CPF

A huge amount is returned back to our CPF.

$264k + accrued interest of $32k

That’s because when we bought the BTO, we wipe out most of our OA for the downpayment, and we continue to use CPF to pay for the monthly mortgage. We used very little cash.

Consider the $32k of accrued interest for a moment. That amount is nearly 10% of the purchased price ($340k). If we had sold after 12 years (instead of 6 years), the accrued interest will be more than $64k (interest is compounding)!

IF you have spare cash, I ask you to consider using more cash to pay for your property, especially in 2020 when risk-free interest is so low. Only CPF will pay you 2.5% no matter what.

Of course, all the $296k in our CPF can be used to pay for our subsequent property.

But taking my own advise this time round, we will not use all of our CPF. We will use around $100k out of the $296k, thus conserving $200k in CPF to earn the 2.5% interest.

I will perhaps write my next post: “How I buy my condo without an agent”.

Related:

- How I Sell My HDB Without an Agent

- Should I Use Cash or CPF to Pay for My Property?

- CPF Interest is up to 6%. That is Marketing Bullshit.