I registered GST voluntarily in Feb this year. Then for my first quarterly filing, I was FINED $200 because I was late.

I emailed to the tax officer:

I definitely did file for GST on Apr 16. Did something go wrong?

The officer did not reply, even past the 5 working days. I forgive them since they must be overwhelmed during COVID.

So I try to rectify myself. I did that by e-filing again.

Turns out, I need to approve each GST filing

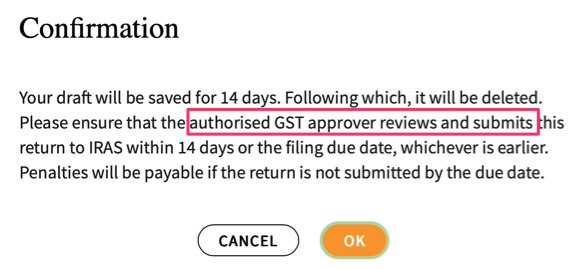

I read carefully this time, and saw this after I finish the e-filing.

Ah, so someone has to approve.

Who?

In my case, it is myself, because I am a sole-proprietor.

Duh.

How to make one an approver?

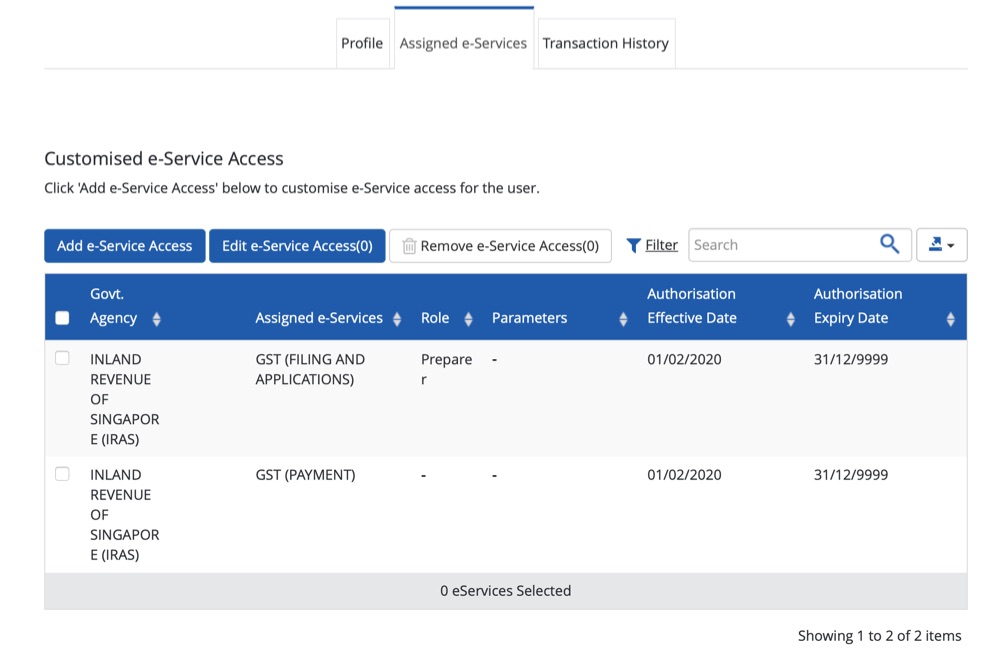

For that, I need to login to CorpPass, and edit under the e-services.

As above, my role is merely a Preparer. WTH they set me up as that is another question they have to ask themselves.

Obviously I have to change the role to Approver.

Then go IRAS again

After which, login to IRAS and go e-file again. This time, it will skip the “waiting for approval” status.

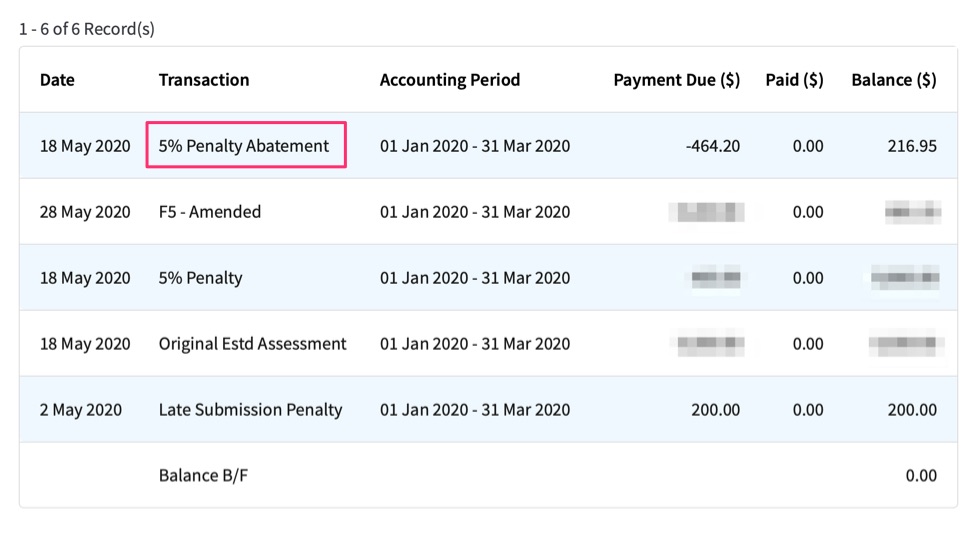

The transactions update instantly, including magically waiving off the late fee penalty!

Kudos to the automatic waiver! I guess so many “new users” will have the issue, or other issues, that they automatically just waive for businesses. Tough time anyway. 😅