I setup a DBS Vickers account way back in 2010, when it is probably one of better trading platform in Singapore.

But for 5 years, it stayed the same, while others got better.

The Business Model of Commission

In 2011, Standard Chartered trading introduced “no minimum commission” - which is very good for traders who buy in small quantities (like doing dollar averaging).

For example, DBS Vickers would charge a minimum of $29 USD for trading a U.S. share, while Standard Chartered could charge only a dollar! DBS Vickers charged nearly 30 times more!

The exorbitant minimum commission is what I can’t stand most.

In addition, they have a custodian fee - I was charged like $6 per quarter for holding 1 US counter.

DBS Vickers business model is way worse compared to Standard Chartered.

A Old Telephone Service

DBS Vickers probably is focusing on the older generation who used phone to call in to trade.

Because for certain functions, you still MUST use the phone.

For example, every time I need to withdraw my cash balance to my bank (even my DBS bank account), I need to call their hotline, and speak to a human.

I can’t believe they call themselves an online platform.

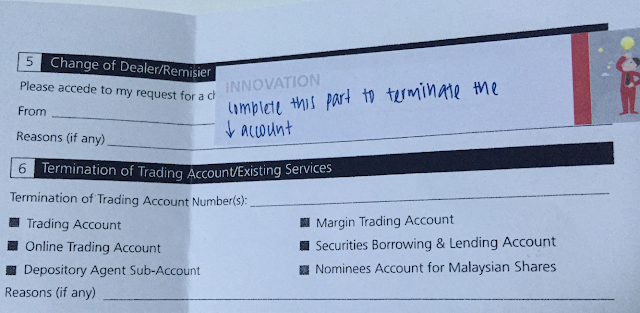

Cancelling the Account

I should have canceled much earlier (I was already using SC since few years ago), but I waited as I am still holding one last stock on their platform, waiting to sell.

Over the telephone, they transferred me to an operator, who simply confirmed they will send me a form to my address.

By mail, is the only way they can cancel the account.

Not even over the phone can you do that. OMG!